让建站和SEO变得简单

让不懂建站的用户快速建站,让会建站的提高建站效率!

发布日期:2024-12-23 16:42 点击次数:167

本文全面剖判了2025年全球经济和金融阛阓的趋势走向,涵盖了股票阛阓、债券阛阓、外汇阛阓、信贷阛阓、新兴阛阓、大批商品阛阓等多个领域。

What’stheoutlookforglobalmarketsin2025?

Theglobalmacroeconomiclandscapecouldbecomemorefluidin2025asmarketsfaceincreasingcomplexity.Inthecomingmonths,theevolutionofthebusinesscyclewilllikelybedrivenbytheinteractionbetweenmacrodynamicsandmonetarypolicy,withaddeduncertaintyfrompotentialpolicychangesbythenewU.S.administration.

Inaddition,technologicalinnovationandthebroadeningoftheAIcycleisexpectedtoremainanimportantdriveracrossmarkets,withmonetizationbecomingagreaterfocusinthecomingquarter.

“Aswetransitioninto2025,althoughbusinesscycledynamicsremaincrucialtotheoutlook,therewillbeheightenedfocusonpolicychangesintheU.S.acrosstrade,immigration,regulatoryandfiscalpolicies.ThesechangesshouldsignificantlyinfluenceoutcomesintheU.S.andbeyond,”saidHusseinMalik,headofGlobalResearchatJ.P.Morgan.

Allinall,J.P.MorganResearch’sbaselinescenariofor2025isonethatseesglobalgrowthstillremainingstrong.U.S.exceptionalismisexpectedtobolstertheU.S.dollarandbuoyU.S.riskyassets,buttheoutlookappearsmoremixedforTreasuries.J.P.MorganResearchisbroadlyconstructiveoncredit,anticipatingmodestchangesinhigh-gradespreads,butremainscautiousonEMfixedincome.Inaddition,theoutlookforU.S.equitiesandgoldisbullish,butbearishonoilandbasemetals.

“Thebackdropofpolicyuncertaintycombinedwithgeopoliticalrisks,however,suggestsincreasingmacroeconomicvolatilityandawiderrangeofpotentialoutcomes,”Maliknoted.

2025年全球阛阓揣度怎样?

2025年,全球经济大环境可能会更复杂多变,阛阓的不祥情味也会进一步加多。在接下来的几个月里,宏不雅经济走势和货币政策之间的互动将主导生意周期的发展,好意思国新一届政府可能出台的政策变化,会给阛阓带来不少变数。

技艺立异,尤其是东说念主工智能的快速发展,依然会是推动阛阓前进的弥留力量。在接下来的季度里,公共会更暖热怎样将这些立异实在变现。

摩根大通全球参谋掌握HusseinMalik表示:“跟着咱们步入2025年,生意周期的变化自然弥留,但好意思国政策场合的调遣,比如贸易、外侨、监管和财政等方面,会引起更往常的暖热。这些政策变化不仅会影响好意思国,还会触及全球经济。”

摩根大通参谋团队以为,2025年全球经济的基本面依旧重大。好意思国经济的强势进展可能会赓续因循好意思元,并推高好意思国的高风险金钱,但对国债阛阓来说,远景就没那么生动了。摩根大通合座看好信用阛阓,以为高评级债券的利差波动不会太大,但对新兴阛阓的固定收益金钱依然合手严慎立场。此外,好意思国股市和黄金被看好,而石油和基本金属的进展可能不太乐不雅。

HusseinMalik指出:“政策的不祥情味加上地缘政事风险,可能会让全球经济波动加重,阛阓的走势也会变得愈加难以预测,”

Equitymarkets

In2025,globalequitymarketscouldfaceanenvironmentcharacterizedbyseveralcross-currents.“Thecentralequitythemefornextyearisoneofhigherdispersionacrossstocks,styles,sectors,countriesandthemes.Thisshouldimprovetheopportunitysetandprovideahealthierbackdropfortheactivemanagementindustryafterconsecutivequartersofrecordnarrowandunhealthyequityleadership,”saidDubravkoLakos-Bujas,headofGlobalMarketsStrategyatJ.P.Morgan.

De-couplingcentralbankpaths,unevendisinflationprogressandtechnologicalinnovationwilllikelycontinuetodrivedivergenceacrossbusinesscyclesglobally.Moreover,heightenedgeopoliticaluncertaintyandevolvinggovernmentpolicyagendascouldintroduceunusualcomplexitytothestockmarketoutlook.

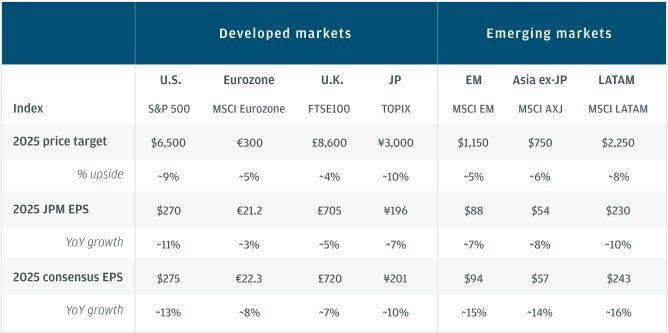

Inlightofthesefactors,thecurrentpolarizedregionalequityperformancewilllikelypersistgoinginto2025,withU.S.equitiespreferredovereurozoneandEM.FortheS&P500,J.P.MorganResearchestimatesapricetargetof6,500nextyear,withEPSof$270.

“TheU.S.couldremaintheglobalgrowthenginewiththebusinesscycleinexpansion,ahealthylabormarket,broadeningofAI-relatedcapitalspending,andtheprospectofrobustcapitalmarketsanddealmakingactivity,”Lakos-Bujasnoted.“Ontheotherhand,Europecontinuestofacestructuralchallenges,whileEMstruggleswithhigher-for-longerrates,thestrongU.S.dollarandincrementaltradepolicyheadwinds.”

Elsewhere,Japaneseequitiesstandtobenefitfromdomesticreflationwithimprovingrealwagegrowth,acceleratingbuybacksandcontinuedcorporatereforms.Theycouldalsoreceiveaboostfromstrongdemandandfavorablecurrencyratesontheinternationalstage.

“Overall,as2025progresses,thereexiststhepotentialforaconvergencetrade,givenextremerelativepositioning,valuationsandpricedivergencesacrossregions.However,moreclarityisfirstneededonglobaltradepoliciesandtheU.S.inflationdynamic—thatthelatterkeepsmovingintherightdirection,”Lakos-Bujassaid.

“Wethinkthekeyriskforourbasecaseandespeciallytheriskiersegmentsofthemarketisonewherethedisinflationprogressfullystallsandstartstoreverse,forcingtheFederalReserve(Fed)toopendoorstopotentialhikeslaterin2025orearly2026.Ifthisscenarioweretostartplayingout,wewilllikelyhavetorevisitouroutlook,”Lakos-Bujasadded.

股票阛阓揣度

2025年全球股票阛阓可能会在多重身分的交汇下迎来一个复杂的风景。摩根大通全球阛阓策略掌握DubravkoLakos-Bujas表示:“来岁股票阛阓的中枢主题是分化加重——无论是在个股、作风、行业、国度如故投资主题上。这种分化有望为投资者提供更多契机,也会为主动管束行业创造更健康的阛阓环境,毕竟此前多个季度的阛阓进展过于集中且不健康。”

列国央行政策旅途的不对、通胀下放慢度的不平衡以及技艺立异的激动,可能会赓续拉大全球不同地区生意周期的各异。此外,地缘政事的不祥情味加多,以及列国政府政策议程的演变,皆将为股票阛阓的远景增添额外的复杂性。

受这些身分影响,区域间股票阛阓进展的南北极化可能会延续到2025年,摩根大通更看好好意思国股票,而相对不太喜爱欧元区和新兴阛阓。摩根大通揣度标普500指数来岁的办法点位为6,500点,每股收益(EPS)将达到270好意思元。

Lakos-Bujas:“好意思国可能会赓续演出全球增长引擎的变装,因为好意思国正处于生意周期扩展阶段,劳能源阛阓安详,东说念主工智聪颖系成本开销陆续扩大,成本阛阓和往复活动也有望保合手活跃。”“比拟之下,欧洲仍濒临结构性挑战,而新兴阛阓则受到高利率合手续时候更长、好意思元走强以及贸易政策压力增大的影响。”

日本股市方面,由于国内经济复苏,骨子工资增长改善,股票回购加速以及企业校正合手续激动,日本股市有望受益。同期,来自国际阛阓的重大需求以及成心的汇率也将为日本股市提供额外援力。

Lakos-Bujas:“总体来看,跟着2025年的激动,区域阛阓之间的差距有可能出现不停,主要基于顶点的阛阓仓位、估值和价钱分化气象。但这一趋势的出现需要更多的明深信号,比如全球贸易政策走向,以及好意思国通胀是否会合手续降温。不外,通胀放缓停滞甚而反弹是面前预期濒临的主要风险,这种情况可能迫使好意思联储在2025年底或2026年头再行琢磨加息。要是这一情形真实发生,摩根大通可能需要再行评估对阛阓的揣度。

2025equityindexpricetargetsandEPSforecasts

图:2025年股票指数价钱办法和每股收益预测

The global economy

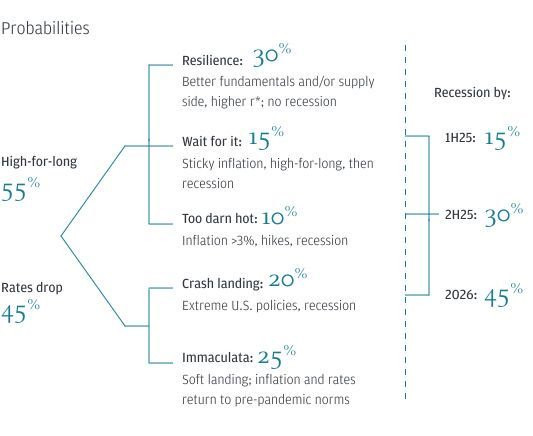

In2024,theglobalexpansionprovedresilientdespiteelevatedinflationlimitingcentralbanks’scopeforratecuts.J.P.MorganResearch’s2025baselineforecastincorporatesanextensionofthishigh-for-longrateenvironment.GlobalGDPisanticipatedtorise2.5%andcoreCPIinflationcouldremainsticky,remainingclosetoitscurrent3%.Whileconsistentwithlimitedeasingintheaggregate,theglobalimpulsesthathavepromotedsynchronizationareexpectedtofade,anddivergenceamongcentralbanksisakeyoutlooktheme.

Thisviewcontrastswithconsensusprojectionsbycentralbanksandprivateforecasters,whichseecoreCPIinflationapproaching2%andsubstantialeasing.“Ourtop-downglobaloutlookisbuiltonanalternativenarrativeinwhichtheinteractionofthepandemicshockandaggressivepolicyresponsesgeneratesreverberationsthatsustainelevatedinflationandpolicyrates,”saidBruceKasman,chiefeconomistatJ.P.Morgan.“Thishigh-for-longbaselinechallengesconsensusthinkingintwoimportantways.First,weseegoodspricedisinflationashavingendedanddonotenvisionamacroeconomicbackdropthatsupportsareturnofservicepriceinflationtopre-pandemicnorms.Second,weseethepowerfulglobalimpulsesthathadpromotedsynchronizationfading.”

Regionaldivergencesininflationandpolicyratescouldbecomeprominentasaresult.WesternEuropecouldremainaweaklinkandeuroareapolicyratesareforecasttofallbelow2%.Incontrast,limitedactionisexpectedbytheFedandmostEMcentralbanks,whichcouldbesupportiveofa“high-for-real-long”ratenarrative.

UncertaintiesrelatedtoU.S.policyandgeopoliticsloomlarge.Ifthenewadministrationimplementstargetedtariffsandmodestfiscaleasing,theoverallimpactcouldreinforceU.S.growthoutperformanceandstickyglobalinflation.Butthetailrisksassociatedwithmoreextremetradeandimmigrationpoliciescannotbeignored.

“OurbaselineviewanticipatesaversionoftheTrumppresidencythatistamerthanwhathecampaignedon.Akeyrisktotheoutlookisifpolicyshiftsaremoreextreme,”Kasmannoted.“IftheU.S.turnsaggressivelyinwardbysharplycurtailingtradeandattemptinglarge-scaledeportations,thefalloutwouldbeafarmoreadverseglobalsupplyshock.Thedisruptiveimpactwouldbeamplifiedbyretaliationandaglobalsentimentslide,whichwouldbeamajorthreattotheglobalexpansionnextyear.”

365建站Globaloutlookscenarios

全球经济揣度

2024年,高通胀扫尾了央行降息的空间,全球经济扩展依旧展现出了重大的韧性。摩根大通的2025年基准预测标明,高利率合手续时候较长的环境将进一步延续。揣度全球GDP将增长2.5%,中枢CPI通胀可能保合手执意,看守在面前约3%的水平。虽然合座上降息空间有限,但推动全球经济同步增长的能源揣度会渐渐减弱,央行政策分化将成为主要趋势之一。

这一不雅点与列国央行及私东说念主机构的主流预测有所不同。后者广阔以为中枢CPI通胀将接近2%,而全球央行有望大幅减弱政策。摩根大通首席经济学家BruceKasman表示:“咱们的全球宏不雅预测基于一个不同的叙事,即疫情冲击与激进政策反应的相互作用,将合手续激发余波,看守高通胀和高利率环境。这种‘高利率合手续时候更长’的基准预期,从两个弥留方面挑战了主流不雅点:第一,咱们以为商品价钱通缩仍是扫尾,且事业价钱通胀不会缅想疫情前的水平。第二,推动全球同步增长的重大能源正在消退。”

因此,通胀与政策利率的地区各异可能愈发明白。西欧可能仍是全球经济的“薄弱风景”,揣度欧元区政策利率将降至2%以下。比拟之下,好意思联储及大多数新兴阛阓央行的行径有限,这可能强化“高利率长久看守”的预期。

好意思国政策与地缘政事的不祥情味也将成为影响全球经济的关节身分。如

果好意思国新一届政府实施有针对性的关税和限度的财政宽松,合座影响可能会进一步强化好意思国经济的重大进展,并推动全球通胀居高不下。但是,若贸易和外侨政策出现更顶点的转向,潜在风险侵扰暴虐。

BruceKasman:“咱们的基准预测中,揣度好意思国政策的骨子实行力度会较竞选时的激进言论有所不停。但关节风险在于,要是政策转向愈加顶点,情况将大不疏导”。“比如,要是好意思国大幅扫尾贸易,好像大畛域终结外侨,这将激发更为严重的全球供应冲击,而袭击性措施和阛阓信心下滑将进一步放大这种冲击,给来岁的全球经济扩展带来雄壮挟制。”

图:全球经济揣度情景

Rates

Atagloballevel,thebasecasemacroviewassumesgrowthresilienceandstickyinflation,whichlimitsthemagnitudeoffurtherpolicyrateeasingin2025.Asaresult,DMpolicyrateswilllikelyremainhigherforlonger,albeitwithcontinueddivergencebetweenU.S.andeuroarearates.

However,thenewTrumpadministrationcouldresultintailrisks,includingadownsidescenariowhereoverlyaggressivetradeandmigrationpoliciesresultinanadversesupply-sideshockandnegativehittoglobalsentiment.Allinall,J.P.MorganResearchexpectsDMyieldstogrindloweroverthecourseof2025.

IntheU.S.,therecouldbemoreroomforthefrontendofthecurvetooutperformastheFedeasesthroughthethirdquarterof2025.“Fedexpectationsarecurrentlypricinginashalloweasingcyclebutpolicyuncertaintyislikelytocontinueinthefirsthalfof2025,”saidJayBarry,headofGlobalRatesStrategyatJ.P.Morgan.“Assuch,weforecast10-yearyieldstofalltoalowof4.10%inthethirdquarterandtoreboundto4.25%byyearend.”

TheoutlookappearsdimmerinEurope,wheretheeconomycouldgrowatasluggishsub-potentialpaceduetoheightenedtradeuncertainty.“Theeuroareaislikelytobetheweakestlinkintheglobaloutlook,andwehaveabiasforlongdurationinintermediateEURversusUSDyields,”saidFrancisDiamond,headofEuropeanRateStrategyatJ.P.Morgan.

OverinJapan,ratesareexpectedtocontinuerisingin2025,drivenbytheBankofJapan’smorehawkishstancecomparedtocurrentmarketpricinganditsdecreasingownershipofthecouponJGBmarket.“Weexpectmodestbearflatteninginthecashspace,butwehaveastrongerconvictionintheflatteningofthefrontendofthecurve,”addedTakafumiYamawaki,headofJapanFixedIncomeResearchatJ.P.Morgan.

利率揣度

从全球层面来看,摩根大通的基准宏不雅预期是:经济增长展现韧性,通胀依然执意,这将扫尾2025年政策利率进一步下调的幅度。因此,发达阛阓(DM)的政策利率可能会看守在较高水平更永劫候,但好意思国和欧元区利率走势的分化将合手续存在。

要是新一届特朗普政府引申过于激进的贸易和外侨政策,可能会带来供应端冲击,并对全球阛阓脸色变成负面打击,成为尾部风险身分。合座来看,摩根大通参谋团队揣度,发达阛阓收益率将在2025年迟缓下行。

好意思国方面,短期债券收益率可能有更大的进展空间,因为好意思联储揣度将在2025年第三季度开动降息。摩根大通全球利率策略掌握杰伊·巴里表示:“阛阓面前预期好意思联储将参加一个较浅的降息周期,但政策不祥情味可能会在2025年上半年合手续。”因此,摩根大通揣度10年期国债收益率将在第三季度降至4.10%,并在年底反弹至4.25%。

欧洲的远景更为阴郁,由于贸易不祥情味加重,欧洲经济可能将看守在低于后劲的增长水平。弗朗西斯·戴蒙德指出:“欧元区可能是全球经济远景中最弱的一环,咱们倾向于在中期欧元收益率与好意思元收益率之间遴荐作念多久期。”

日本方面,揣度2025年利率将赓续上升,主要受到日本央行鹰派立场的推动,与面前阛阓订价存在各异。此外,日本央行在削减合手有的日本政府债券(JGB)方面也会有所行为。摩根大通日本固定收益参谋掌握山脇贵文表示:“咱们揣度现货阛阓会出现柔和的熊市平坦化,但咱们更看好短期利率弧线的平坦化趋势。”

FX

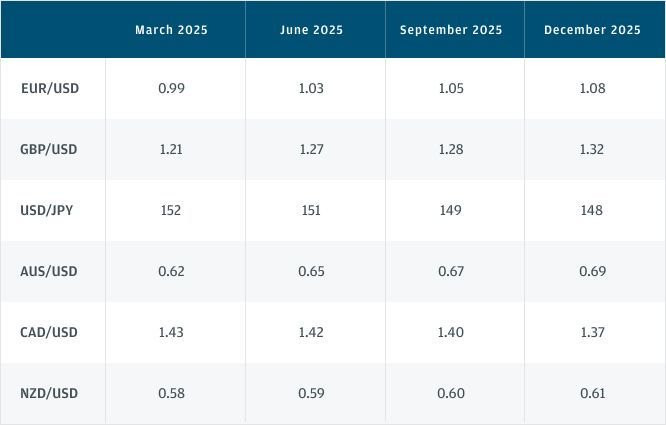

In2025,thepolicyfalloutfromtheU.S.electionwilllikelyinformthedirectionofFXmarkets.Butbeyondthis,classicalFXdriverssuchascyclical/policydifferentiationandvaluationsareexpectedtoplayakeyroleaswell.

J.P.MorganResearchisbullishontheU.S.dollar,whichcouldstrengthentonewhighsinthecomingmonths.“November’selectionoutcomehasgivenwaytolowerglobalgrowthexpectations,widergrowthgapsbetweentheU.S.andtherestoftheworld,andhigherterminalFedfundsrateforecastsfor2025—theperfecttrifectaofbullishUSDcyclicalimpulses,”saidMeeraChandan,co-headofGlobalFXStrategyatJ.P.Morgan.“Theseareearlyfirst-orderreactionsthatmaygivewaytodeeperrethinksoncethefullsetofTrumpadministrationpoliciesareknownnextyear,butfornow,theyconstituteasolideconomicrationaleforcarryingalongUSDstanceintothefirstquarterof2025.”

Incontrast,theoutlookfortheeuroisbearish,especiallyastheeurozoneisparticularlysusceptibletotradeconflicts.“OurEUR/USDforecastlooksforatestofparitybythefirstquarterof2025astariffrisksgetmorefullypricedin,”Chandansaid.However,EUR/USDcouldpotentiallyrecoverto1.08laterintheyearduetomitigatingfactorsincludingtariffreductions,aresolutionoftheRussia–UkraineconflictandaslowdowninU.S.growth.

Whilesterlinghasbeenthebestperformingcurrencyagainstthedollarin2024,arepeatofthismajoroutperformanceseemsunlikelyinthecomingyear.Instead,GBP/USDisexpectedtofallto1.21inthefirstquarterof2025,beforerecoveringto1.32byDecember.“Overall,riskstosterlingfromweakerU.K.growthandBankofEngland(BoE)easingwilllikelybeoffsetbyrelativeinsulationfromtariffrisksandstill-highyieldin2025.Thismeanssterlingwilllikelymuddlethrough,deliveringlowerreturnsthanrecentyears,”Chandanadded.

InAsia,J.P.Morganseessomecross-currentsforUSD/JPYin2025,withtheJapaneseyenlikelyfindingabottomfollowingfourconsecutiveyearsofunderperformance.“AlthoughdivergenceintheU.S.andJapanmonetarypolicysuggestsamodestdeclineinUSD/JPY,itwouldnotbepowerfulenoughtopushthepairsignificantlylower.Ontheotherhand,structuralfactorsincludingJapan’sweakproductivitygrowthandnegativerealpolicyratecontinuetolimittheyen’supside,”Chandansaid.“Furthermore,excessiveyenweaknessisnotacceptableforbothU.S.andJapanpolicymakers.Ifyendepreciationaccelerates,itwouldbecounteredbymorehawkishyen-buyinginterventions.”Takingthesefactorsintoaccount,J.P.MorganResearchexpectsUSD/JPYtoreach152inthefirstquarterof2025,and148inthefourthquarter.

外汇阛阓揣度

2025年,好意思国大选带来的政策影响将是外汇阛阓的主要驱能源之一。但除了政事身分外,经济周期与政策分化以及估值水对等经典外汇阛阓身分,也将在将来一年起到关节作用。

摩根大通参谋团队对好意思元合手看涨立场,揣度好意思元将在将来几个月内进一步走强,创下新高。摩根大通全球外汇策略联席掌握MeeraChandan表示:“11月大选的成果导致了全球增长预期下调,好意思国与其他国度的增长差距扩大,同期2025年好意思联储利率的预期尽头更高。这三大身分形成了支合手好意思元周期性走强的‘完整组合’。”MeeraChandan指出,这些反应属于初期进展,跟着2025年特朗普政府政策的全面公布,阛阓可能会再行评估,但面前来看,好意思元的强势逻辑足以因循其在2025年第一季度赓续走强。

与好意思元的强势形成对比,欧元的远景偏向悲不雅,尤其是欧元区对贸易突破的明锐性较高。“咱们揣度欧元兑好意思元(EUR/USD)将在2025年第一季度测试平价水平,因为关税风险将被阛阓更充分地反馈。”不外,跟着贸易关税的减少、俄乌突破的处治,以及好意思国经济增长放缓等身分的缓解,EUR/USD可能在年底回升至1.08。

英镑方面,2024年英镑是进展最佳的抗好意思元货币,但这种重大表面前2025年重现的可能性不大。摩根大通揣度英镑兑好意思元(GBP/USD)将在2025年第一季度下落至1.21,但到12月有望回升至1.32。MeeraChandan指出:“虽然英国经济增长放直快英格兰银行(BoE)降息存鄙人行风险,但英镑相对不受关税冲击的影响,同期较高的收益率水平仍将在2025年起到因循作用。因此,英镑的进展可能会相对浅薄,讲演率低于以前几年。”

在亚洲阛阓,摩根大通以为2025年好意思元兑日元(USD/JPY)走势将受到多重身分的影响。日元在联结四年进展欠安后,揣度将触底反弹。MeeraChandan:“虽然好意思国和日本的货币政策分化示意USD/JPY将小幅下落,但这一趋势不及以显赫推低汇率水平。另一方面,日本分娩率增长疲弱和骨子利率为负等结构性身分,也将赓续扫尾日元增值的空间。”日元过度贬值对好意思国和日本的政策制定者来说皆是不成收受的。要是日元贬值速率加速,日本政府可能通过更具鹰派颜色的滋扰措施来买入日元,扼制其进一步走弱。概括这些身分,摩根大通揣度好意思元兑日元(USD/JPY)将在2025年第一季度达到152,并在第四季度回落至148。

Forecastsformajorcurrencypairs

图:主要货币预测

Credit

Lookingto2025,theglobalcreditecosystemremainsfairlyrobust.“Positioningdoesnotfeeloverlystretched,andleverageandcomplexityappearlargelyabsent.Norarethereanyobviousasset-liabilitymismatches,whichtendtoportendfinancialaccidents,”saidStephenDulake,co-headofFundamentalResearchatJ.P.Morgan.“Moreover,all-incorporatebondyields,especiallythoseinNorthAmerica,remainintherightzipcodetounderpinstrongdomesticinstitutionalandinternationaldemand.”

ForU.S.credit,yieldsareexpectedtostayhighthroughout2025,andthiscouldcontinuetoattractstrongdemandandkeepspreadsatverytightlevels.“TherelativestrengthofU.S.growthversusothermarkets,aswellastheexpectationthatU.S.policywillfavorU.S.assetsattheexpenseofotherregions,aresupportiveofstrongoverseasdemandforU.S.credit.Inaddition,corporatecreditqualityisgoodandislikelytostaythatwayin2025,”saidEricBeinstein,headofU.S.CreditStrategyatJ.P.Morgan.

InEurope,thebackdroplooksmorechallenging,withtheU.S.electioncreatinguncertaintyforthecreditmarket.InEuropeaninvestmentgrade,J.P.MorganResearchforecasts15bpofwideningnextyearto130bp,implyingtotalreturnsof4.5%.“Despiteourmacroconcerns,however,wethinkanyspreadwideningwillbelimited,withthetechnicalslikelytoremainstrongoncontinuedyieldbuying,arotationoutofcashintofixedincomeaspolicyratesdecline,andlimitednetsupplyastradeuncertaintyweighsonbusinessinvestmentandacquisitionactivity,”saidDanielLamy,headofEuropeanCreditStrategyatJ.P.Morgan.

Lookingatsecuritizedproducts,housepricesareexpectedtorise3%nextyear.“Althoughunderbuildinghasbeenevidentoverthelastdecade,thelong-termhousingshortageislessclear.Immigrationhasboostedpopulationgrowth,drivingdemand,whilevacancyratespointtopotentialsupplyconstraints,”saidJohnSim,headofSecuritizedProductsResearchatJ.P.Morgan.

Whileagencymortgage-backedsecurities(MBS)havelaggedotherspreadproductsin2024,valuationslookrelativelyattractiveheadinginto2025,withmoreorganicnetsupply($230billion)andbetterbankbuying.

信贷阛阓揣度

揣度2025年,全球信贷阛阓的合座环境依旧安详。摩根大通基础参谋联结掌握斯蒂芬·杜莱克指出:“面前阛阓的仓位并未过度扩展,杠杆和复杂性基本上不存在,也莫得明白的金钱欠债错配问题,这类气象时常会激发金融事故。此外,尤其是在北好意思地区,企业债券的合座收益率仍处于合理水平,这将合手续因循国内机构投资者和国际投资者的重大需求。”

好意思国信贷阛阓方面,揣度2025年收益率将看守在较高水平,这将合手续眩惑大皆需求,并使信用利差保合手在非常紧缩的状态。摩根大通基本面参谋联席掌握StephenDulake表示:“好意思国经济增长的相对强势,以及揣度好意思国政策将倾向于成心于好意思国金钱、而非其他地区的金钱,皆将支合手国外投资者对好意思国信贷的重大需求。此外,企业的信用质地细致,揣度2025年将保合手这一水平。”

欧洲信贷阛阓的局势则相对愈加严峻,主要受到好意思国大选带来的不祥情味影响。摩根大通揣度,欧洲投资级债券的信用利差将在来岁扩大15个基点,达到130个基点,总讲演率约为4.5%。StephenDulake:“虽然咱们对宏不雅经济合手严慎立场,但揣度信用利差的扩大将是有限的。主要原因包括技艺面因循依旧重大——合手续的收益率买盘、政策利率下降后资金从现款向固定收益金钱的轮动,以及由于贸易不祥情味导致的投资与并购活动放缓,从而使得净供应有限。”

在证券化家具领域,揣度2025年房价将飞腾3%。“虽然以前十年房屋配置不及较为明白,但长久的住房供应零落尚不解确。与此同期,外侨增长带动了东说念主口增长,推动了住房需求,而空置率数据则炫耀供应存在潜在瓶颈。”

此外,2024年机构典质贷款支合手证券(MBS)的进展落伍于其他信用利差家具,但参加2025年后,MBS的估值将显得相对具有眩惑力,尤其是在更重大的净供应(约2300亿好意思元)和银行购买力度增强的布景下。

Emergingmarkets

“EMgrowthfacessignificantuncertaintyin2025,caughtbetweentwogiants,ChinaandtheU.S.,withpolicychangesinthelatterpotentiallydeliveringalargenegativesupplyshockthatwillhavespilloversacrossEM,”saidLuisOganes,headofGlobalMacroResearchatJ.P.Morgan.

WhileEMinflationisexpectedtoslowasservicesinflationmoderates,coregoodspricescouldseeatemporaryboostfromtariffsandFXdepreciation.Inaddition,EMcentralbankswilllikelyneedtocontendwithchangesinU.S.financialconditionsandweighfinancialstabilityconcernsagainsttheadverseimpactongrowthfromdeterioratingsentimentandslowingglobaltradeflows.Overall,weakerdomesticgrowthandampleratebufferscouldstillleaveroomforcautiousmonetaryeasingin2025.

“Consideringthesecross-currents,ourbaselineforecastlooksforEMgrowthtoslowfrom4.1%in2024to3.4%in2025.ExcludingChina,EMgrowthwouldeaseonlymoderatelyfrom3.4%to3.0%,”Oganesadded.

Regionaloutlooks

EMAsia:TheregionwilllikelybeinthecrosshairsofanyU.S.–Chinatradewarin2025,andJ.P.MorganResearchexpectsGDPgrowthintheregiontoslowto4%shouldsuchascenariounfold.

EMEMEA:Growthisstillexpectedintheregion,butataslowerpaceandwithdownsiderisks.“Despitethelessupbeatgrowth,wehavedelayedratecutsinvariouscountriesgivenhighandpersistentcoreinflationdynamics,alongwithrisingglobalrisks,”Oganessaid.

LATAM:2025GDPgrowthisexpectedbehigheronaverageversus2024,mostlyonthebackofastrongreboundinArgentina.Whileabove-targetinflationwilllikelyresultinelevatedinterestratesandfiscalconsolidation,medium-termfiscalchallengesremain.

新兴阛阓揣度

“2025年,新兴阛阓(EM)的增永久景濒临紧要不祥情味,主要受到中好意思两大经济体的影响,非常是好意思国政策变化可能激发的供应端冲击,这将触及新兴阛阓,”摩根大通全球宏不雅参谋掌握路易斯·奥加内斯表示。

跟着事业通胀放缓,新兴阛阓的合座通胀揣度将有所下降,但受关税和外汇贬值影响,中枢商品价钱可能会一刹走高。新兴阛阓的央行还需唐突好意思国金融情状的变化,在金融康健性和增长放缓之间作念出量度,非常是在阛阓脸色恶化和全球贸易放缓的情况下。合座来看,国内增长疲弱,但充足的利率缓冲空间仍可能为2025年严慎的货币宽松提供一定余步。

“概括这些复杂身分,咱们的基准预测是新兴阛阓增长将从2024年的4.1%放缓至2025年的3.4%。剔除中国后,新兴阛阓的增长将从3.4%小幅降至3.0%”。

区域揣度

亚太新兴阛阓(EMAsia):

2025年,亚太地区将成为中好意思贸易战的主要受害者之一。摩根大通揣度,若此情景发生,该地区的GDP增长将放缓至4%。

欧洲、中东及非洲(EMEMEA):

该地区仍将保合手增长,但速率会有所放缓,且濒临下行风险。“虽然经济增长预期不够乐不雅,但琢磨到中枢通胀较高且合手续,加上全球风险上升,咱们推迟了多个国度的降息筹画。”

拉丁好意思洲(LATAM):

揣度2025年GDP增长将较2024年有所改善,主要获利于阿根廷经济的重大复苏。但是,高于办法的通胀可能导致利率看守在较高水平,同期随同财政整顿。不外,该地区在中长久仍濒临财政挑战。

Commodities

Trump’sreturntotheWhiteHouseshouldseeafocusedagendawithapromiseto“rapidlydefeatinflation,quicklybringdownpricesandreigniteexplosiveeconomicgrowth.”Muchofhisstrategyreliesonreducingenergyprices,andhehaspledgedtoloweroilcosts.Undertheseplans,deregulationandincreasedU.S.productionpresentdownsideriskstooilprices,whileupsiderisksareposedbyexertingpressureonIran,VenezuelaandpossiblyRussiatolimitoilexportsandrevenues.Weaksupply-demandfundamentalsmay,however,helpTrumpkeephispromisetobringoilpricesdown.

J.P.MorganResearch’sviewhasremainedlargelyunchangedoverthepastyear,withexpectationsofashiftfromabalancedmarketin2024toalargesurplusin2025.“Welookforalarge1.3millionbarrelsperday(mbd)surplusandanaverageof$73perbarrel(bbl)forBrent,althoughweexpectpricestoclosetheyearfirmlybelow$70,withWTIat$64/bbl,”saidNatashaKaneva,headofGlobalCommoditiesStrategyatJ.P.Morgan.Crucially,theseforecastsassumethatOPEC+staysputatcurrentproductionlevels.

Turningtonaturalgas,boththeEuropeanandU.S.marketsarelikelytoremaininafairlybalancedstate,weather-adjusted,untilsupplygrowthbecomesapparent.“FortheEuropeannaturalgasmarket,withgrowingbaseloadneedsaroundtheglobe,supplygrowthmaynothappenuntilmid-2026,”saidShikhaChaturvedi,headofGlobalNaturalGasandNaturalGasLiquidsStrategyatJ.P.Morgan.“However,fortheU.S.naturalgasmarket,itcouldbeasearlyaslate-2025,asmidstreaminfrastructureisexpectedtoallowformoremovementofmoleculesfromproductionzonestodemandregionsintheGulfofMexico.”

Therallylookssettorumbleonforpreciousmetals,withconstrainedsupplysettingthestageforstrongerbasemetalpriceslaterin2025.“Wemaintainourmulti-yearbullishoutlookongoldasthemostlikelymacroscenariosin2025stillskewbullishforthemetal,”saidGregoryShearer,headofBaseandPreciousMetalsStrategyatJ.P.Morgan.“Weareforecastingpricestorisetowards$3,000/oznextyear.”

Whataboutsilver?“Silver’stimetoshinecomesafterbasemetalslikelyfindingabottominearly2025,”Sheareradded.“Weseeacatchuptradepropellingsilverpricestoward$38/ozbyyear-end.”

Foragriculturemarkets,alowinventorybaseatthegloballevelcontinuestolimitdownsidepricerisksinto2025.Morevolatilitycouldlieahead,though.“U.S.trade,foreignpolicyandwidergeopoliticaldevelopmentsaheadaddcomplexitythroughthe2025/26balances,withmoreimmediateimpactsforprice,”saidTraceyAllen,anagriculturalcommoditiesstrategistatJ.P.Morgan.“Weanticipateamorevolatilepriceenvironmentforagriculturalcommoditiesthrough2025–2026,particularlyforU.S.trade-exposedsoybean,corn,cottonandwheatmarkets.”

大批商品揣度

跟着特朗普缅想白宫,其政策重心将围绕“赶快击败通胀、快速镌汰物价并重燃经济增长”伸开。特朗普的策略很猛流程上依赖于降嚚猾源价钱,他喜悦将压低石油价钱。在这些筹画下,减弱管制和加多好意思国能源产量可能对油价组成下行风险;但与此同期,对伊朗、委内瑞拉甚而俄罗斯施压以扫尾其石油出口和收入,则可能推动油价上行。由于供应和需求的基本面较弱,这些条目可能匡助特朗普达成其镌汰油价的喜悦。

摩根大通的参谋不雅点在以前一年中保合手基本不变,揣度石油阛阓将从2024年的供需平衡转向2025年的大幅饱和。摩根大通全球大批商品策略掌握NatashaKaneva表示:“咱们揣度2025年石油阛阓每天将有130万桶的饱和供应,布伦特原油的平均价钱将为73好意思元/桶,揣度年底价钱将跌破70好意思元,WTI原油价钱揣度为64好意思元/桶。”这些预测的前提是OPEC+保合手面前的分娩水平。

自然气方面,欧洲和好意思国阛阓在天气调遣后可能会保合手相对平衡的状态,直到供应增长认知。摩根大通全球自然气和自然气液计策掌握ShikhaChaturvedi表示:“关于欧洲自然气阛阓,由于全球对基荷能源需求的增长,供应增长可能要到2026年年中才会出现。而关于好意思国自然气阛阓,跟着中游基础设施的配置,揣度到2025年底就能达成更多从产区向墨西哥湾需求区的分子运输。”

贵金属揣度将赓续飞腾,而供应受限可能为基本金属价钱在2025年后期走强奠定基础。摩根大通基本金属和贵金属策略掌握GregoryShearer表示:“咱们对黄金保合手多年的看涨预期,因为2025年最可能的宏不雅经济场景仍倾向于利好黄金。咱们预测黄金价钱将在来岁飞腾至3,000好意思元/盎司。”

白银呢?“白银的进展将在2025年头基本金属触底后开动发力。”Shearer补充说,“咱们揣度补涨行情将推动白银价钱在年底达到38好意思元/盎司。”

农业商品阛阓方面,全球范围内的低库存赓续扫尾价钱下行风险,但波动性可能会加重。摩根大通农家具策略师TraceyAllen表示:“2025/26年度,好意思国贸易、酬酢政策以及更往常的地缘政事发展,将使供需平衡愈加复杂,并对价钱产生更径直的影响。咱们揣度农业大批商品价钱在2025-2026年将处于更波动的环境,尤其是对好意思国出口依赖较高的大豆、玉米、棉花和小麦阛阓。”

Globalcommoditypriceforecasts

图:全球大批商品价钱预测

(转自:中国地产基金百东说念主会)